Voici pourquoi les milléniaux utilisent encore des chèques

Dans une récente étude réalisée par Qualtrics sur les millennials, une statistique surprend. Lorsqu'il s'agit de transactions de consommation, les applications de paiement telles que Zelle ou CashApp sont populaires, mais le chèque papier, qui a fait ses preuves, est toujours d'actualité.

42 % des milléniaux font encore régulièrement des chèques, ce qui est plus que la plupart des consoles de jeux vidéo qu'ils possèdent. Cela signifie que les milléniaux sont presque trois fois plus nombreux à utiliser des chèques que des plateformes de paiement mobile. De plus, les milléniaux sont cinq fois plus susceptibles d' utiliser des espèces que des plateformes de paiement mobile ou même des cartes de débit.

Quelle est la cause de cette tendance ? Ce n'est peut-être pas aussi surprenant que vous le pensez.

Les milléniaux : La génération des travailleurs indépendants

L'utilisation des chèques par les millennials peut être attribuée à des circonstances socio-économiques uniques. En particulier, ils se sont tournés vers le travail indépendant et l'économie des petits boulots. Contrairement aux générations précédentes, les millennials sont de plus en plus attirés par le travail en free-lance, l'entrepreneuriat et les activités annexes.

En 2016, on prévoyait que 10,5 millions de personnes aux États-Unis deviendraient des travailleurs indépendants d'ici à 2030, mais ce chiffre a augmenté plus rapidement que prévu.

Fin 2019, 30 % des Américains travaillaient en tant que freelances. En 2022, 4 millions de nouvelles entreprises ont été créées aux États-Unis, ce qui représente encore une augmentation de 30 % par rapport à 2019.

L'utilisation des chèques dans le monde des petites entreprises

Vous vous demandez peut-être quel est le rapport entre le travail indépendant et la résurgence des chèques ? En effet, les indépendants ont souvent l'habitude de facturer directement leurs clients, et quelle est la forme la plus courante de transaction interentreprises ? Les chèques.

Les chèques représentent 51 % des paiements interentreprises, et 81 % des entreprises déclarent qu'elles utilisent encore des chèques de temps en temps, même si ce n'est pas leur méthode préférée. Lorsqu'il s'agit de petites entreprises, les fournisseurs peuvent préférer être payés par chèque, et ces chefs d'entreprise du millénaire doivent être prêts à en émettre un pour obtenir leur matériel.

Pourquoi pas les paiements numériques ?

Contrairement aux plateformes de paiement numérique qui peuvent imposer des frais de transaction, les chèques permettent aux particuliers de garder le contrôle total de leurs revenus sans être soumis à des intermédiaires tiers. Cet avantage est particulièrement précieux pour les indépendants et les propriétaires de petites entreprises qui souhaitent conserver autant d'argent que possible sans avoir à payer de frais inutiles.

La fraude est également un risque majeur pour les paiements numériques. La popularité d'applications de paiement telles que CashApp ou Zelle en a fait une mine d'or, cette dernière recueillant 490 milliards de dollars de transferts rien qu'en 2023. La fraude ACH a augmenté de 6 % depuis 2021, et comme les fraudeurs sont de plus en plus habiles en matière de technologie, les risques et les pertes ne feront qu'augmenter.

Les escroqueries aux paiements numériques sont plus risquées que le vol d'une seule transaction. Zelle s'appuie sur le fait que les utilisateurs connectent leurs comptes bancaires et leurs cartes de débit directement à la plateforme, ce qui signifie que si un seul transfert est piraté, les fraudeurs peuvent aller beaucoup plus loin.

De tels dangers peuvent être préjudiciables à une petite entreprise.

La sécurité des chèques

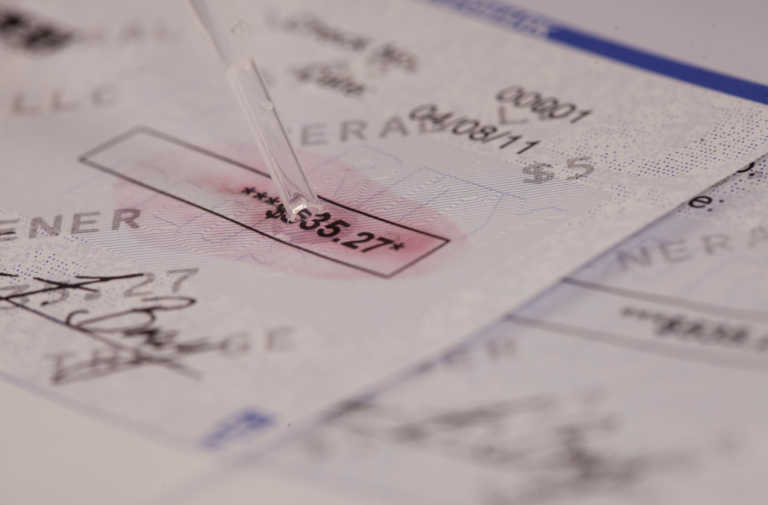

Si les chèques restent une méthode fiable, ils présentent eux-mêmes des lacunes en matière de sécurité. La fraude sur les chèques est en augmentation, avec 680 000 cas signalés en 2022. En 2024, on s'attend à ce que les pertes liées à la fraude par chèque atteignent 24 milliards de dollars. Au cœur du problème, les anciennes techniques de fraude comme le vol de courrier et le lavage de chèques sont de plus en plus répandues. En 2023, 815 millions de dollars seront attribués à des stratagèmes de lavage de chèques .

Cependant, la différence entre la fraude par chèque et la fraude ACH est énorme. Lorsqu'il s'agit de chèques, non seulement la fraude est localisée à un seul paiement, mais vous pouvez protéger activement vos chèques avec les solutions TROY.

Le lavage de chèque se produit parce que l'encre ou le toner MICR (Magnetic Ink Character Recognition) avec lequel le chèque doit être imprimé peut être facilement lavé ou raclé. Le toner MICR standard n'offre aucune protection contre le lavage des chèques, mais le TROY MICR Toner Secure en offre une.

Le toner MICR Secure de TROY est non seulement un toner à haute adhérence qui répond aux exigences bancaires, mais il est également conçu pour prévenir la fraude. Le toner MICR Secure contient le colorant rouge breveté de TROY qui saigne en rouge chaque fois qu'une altération chimique a été tentée. Cela permet d'alerter la banque de la fraude et le fraudeur qu'il a été pris en flagrant délit.

Solutions d'impression de chèques sécurisés de TROY

Associé à nos autres solutions d'impression de chèques sécurisés, les propriétaires de petites entreprises peuvent commencer à imprimer des chèques en interne tout en conservant toutes leurs données clients et leurs informations de paiement en un seul endroit.

TROY FlexPay : TROY FlexPay est notre logiciel de paiement sécurisé et basé sur le cloud pour les petites entreprises. Il s'intègre aux données clients QuickBooks de l'utilisateur et lui donne la possibilité de payer ses fournisseurs par ACH, par chèque numérique, par service de traitement des chèques ou d'imprimer son propre chèque en interne, le tout à partir d'une seule et même plateforme.

TROY MICR Toner Secure : Comme nous l'avons mentionné, TROY MICR Toner Secure est le seul toner MICR capable de protéger activement les chèques contre le lavage grâce à notre colorant rouge breveté qui saigne en rouge chaque fois que l'on tente de laver un chèque. Aucun autre toner MICR au monde ne peut faire cela.

Imprimantes MICR TROY HP sécurisées : Grâce à notre partenariat OEM avec HP, TROY est autorisé à prendre une imprimante HP standard et à l'améliorer avec la capacité d'imprimer en toute sécurité des MICR sur les chèques. Ces imprimantes MICR sont dotées de fonctions de sécurité avancées telles que la technologie de positionnement exact pour que vos lignes MICR soient imprimées correctement, des vérifications utilisateur uniques, la détection de toner, et bien plus encore.

Alors que la génération millénaire des travailleurs indépendants continue de tracer de nouvelles voies et d'adopter des modes d'emploi alternatifs, les chèques resteront sans aucun doute un marteau dans leur boîte à outils financière. Avec la solution de bout en bout personnalisable de TROY pour imprimer et envoyer des paiements par chèque sécurisés, les PME n'auront plus jamais à s'inquiéter de la fraude.

Visitez notre magasin pour trouver la solution pour votre entreprise.

Articles connexes

5 questions à poser avant de développer votre succursale avec le libre-service

Si vous êtes un cadre bancaire ou le président d'une petite banque ou d'une coopérative de crédit, vous êtes probablement en train de chercher des moyens pour que votre organisation puisse se développer sans se ruiner sur des...

Votre guide pour choisir le meilleur logiciel d'impression de chèques

Dans le monde rapide des affaires, l'efficacité est essentielle. L'un des domaines où l'efficacité peut avoir un impact significatif est celui de l'impression des chèques et des logiciels d'impression de chèques. En tant que..

5 avantages de l'impression avec des encres à séchage UV

Dans le secteur de l'impression, la rapidité et la fiabilité revêtent une importance capitale. Les clients veulent que leurs travaux d'impression soient réalisés rapidement et sans risque de dommages ou de bavures. L'entreprise..

Laisser une réponse