Quel est le coût réel de l'impression d'un chèque ?

La plupart des entreprises ne sont pas expertes en matière d'impression de chèques, et une petite erreur peut entraîner le rejet d'un paiement par une banque. Les clients de TROY n'ont pas à s'inquiéter de cela, car nos experts sont disponibles pour aider à naviguer dans le processus d'impression des chèques et les avantages en termes d'économies de la manière la plus sécurisée.

Lorsque je discute avec des clients actuels qui cherchent des moyens de moderniser le traitement des paiements et lorsque je m'adresse à des clients potentiels sur le thème général de l'impression des chèques, je commence toujours par poser la même question.

"Combien dépensez-vous par chèque traité aujourd'hui ?

Sans faute, la réponse est presque toujours la même : "Je ne sais pas" ou une variante tout aussi vague. Ne vous méprenez pas, c'est une réponse tout à fait compréhensible et raisonnable à la question. Un grand nombre de clients de TROY n'ont pas pour vocation de créer des chèques, mais il s'agit d'une corvée nécessaire, d'une tâche qui doit être accomplie pour permettre la réalisation de l'activité principale. Il y a aussi l'idée qu'"un chèque est un chèque est un chèque". Il n'y a rien de plus, il n'y a qu'une seule façon de créer un chèque pour payer quelqu'un. C'est dans cet esprit que je lance une mini-série d'articles de blog explorant les coûts d'impression des chèques, le traitement des paiements et la manière de réduire tous les coûts associés.

Le groupe TROY a développé plusieurs nouvelles technologies pour renforcer la sécurité des chèques, réduire les coûts de traitement des paiements et même aider les entreprises à passer facilement de processus obsolètes à des méthodes modernes d'impression de chèques qui permettent de réaliser des économies. Mais avant qu'une entreprise puisse mettre à jour ses flux de travail en toute confiance, il est essentiel de comprendre le flux de travail actuel et les coûts associés.

Commençons par le commencement...

Qu'est-ce qui entre dans le coût de l'impression des chèques ? Tout d'abord, il est impossible d'être parfaitement précis sur ce sujet. Les coûts opérationnels varient d'une entreprise à l'autre et je ne veux pas présumer de votre situation spécifique. C'est pourquoi je formulerai des hypothèses générales et ferai de mon mieux pour donner une fourchette d'estimations destinées à s'appliquer à tous les types d'entreprises. L'objectif de cette série de blogs est de vous fournir des informations sur l'impression de chèques qui vous aideront à contrôler vos coûts.

Une recherche rapide sur Internet permet d'obtenir une large fourchette de 4 à 20 dollars par chèque imprimé - dans certains cas, la fourchette peut être un peu plus large. La plupart des chiffres cités par diverses sources ne sont pas vraiment expliqués. Je n'ai aucun intérêt à citer un chiffre de manière exagérée pour inciter à la vente. Je veux avoir une idée précise de ce que l'impression d'un chèque peut coûter à votre entreprise.

L'envoi de 50 chèques coûte aux entreprises de 200 à 1 000 dollars par mois.

Il n'est pas nécessaire qu'il en soit ainsi, mais nous devons d'abord comprendre pourquoi il en est ainsi.

Les règles

Établissons quelques règles de base, mes hypothèses pour explorer les coûts d'impression des chèques :

Je n'inclurai pas le coût du timbre/de l'envoi.

Je suis d'avis que le fait de regrouper les coûts d'envoi et les coûts des chèques, bien qu'il s'agisse d'un élément à prendre en considération, est davantage un problème lié au processus d'envoi qu'à l'impression des chèques.

Je pars du principe qu'il y a 50 chèques par mois.

C'est un chiffre facile à conceptualiser et à calculer. Il est également largement représentatif du volume de chèques des petites entreprises.

Je me concentrerai sur les coûts "matériels" de l'impression des chèques.

Les consommables (papier, toner, etc.) sont un exemple de coûts fixes.

J'aborderai le sujet des coûts "mous".

- Le coût de la main-d'œuvre/heures serait un exemple de coût "mou". Je qualifie ce coût de "mou" car il varie d'une entreprise à l'autre, et la manière dont la main-d'œuvre est considérée comme un coût par les dirigeants varie également.

Je ne parlerai que de manière générale du temps de travail consacré à l'impression des chèques. Je pense que c'est important, mais je n'ai pas grand-chose à dire sur vos coûts de main-d'œuvre spécifiques. Je souhaite seulement mettre l'accent sur ce point pour qu'il soit pris en considération.

- Je ne veux pas trop présumer de vos coûts de main-d'œuvre spécifiques.

Je citerai les prix pratiqués par les principaux détaillants, tant en ligne qu'en magasin.

Mon objectif est de discuter d'une fourchette réaliste dans laquelle la plupart des chefs d'entreprise pourraient se situer lorsqu'ils achètent du matériel pour l'impression de chèques.

- Bien entendu, les prix peuvent varier en fonction des ventes, des pressions du marché ou de toute autre circonstance inconnue. Toutefois, je m'efforce de donner un aperçu honnête des coûts d'impression de chèques que la plupart des entreprises devraient supporter.

Le papier

La plupart des petites entreprises utilisent des chèques préimprimés pour imprimer leurs chèques. En général, c'est parce que c'est le moyen le plus simple pour une entreprise de traiter et d'envoyer un chèque. C'est rarement, voire jamais, le moyen le plus rentable. La plupart des entreprises ne sont pas expertes en matière d'impression de chèques et il est facile de faire quelque chose que la banque rejettera. Les clients de TROY n'ont pas à s'inquiéter de cela, car nos experts sont disponibles pour les aider à naviguer dans le processus d'impression des chèques.

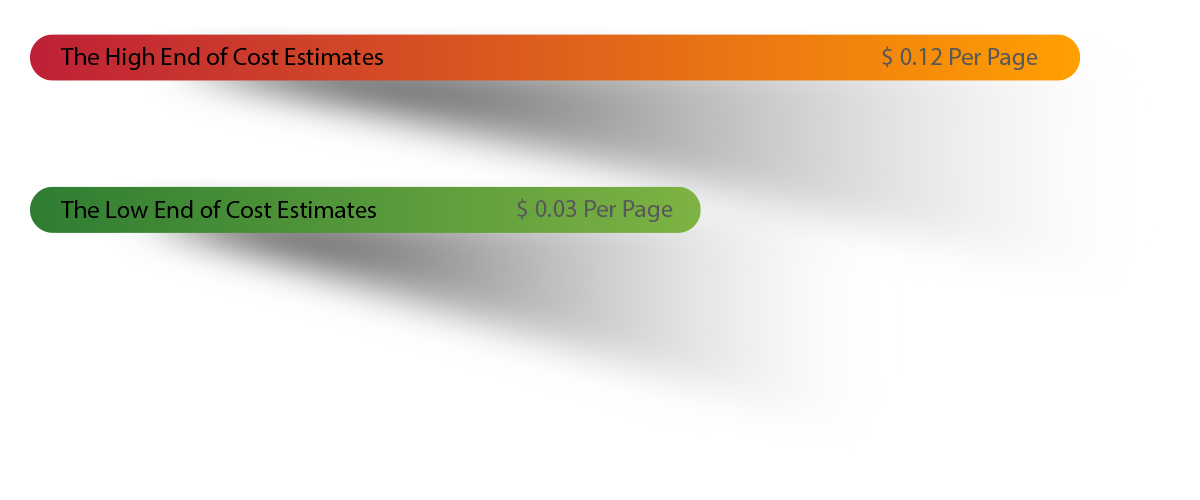

Les prix varient d'un vendeur à l'autre et les options sont différentes ; toutefois, il s'agit de la fourchette prévue entre les options bas de gamme et haut de gamme, en supposant que vous achetiez 150 chèques préimprimés à la fois (soit environ 3 mois d'impression de 50 chèques par mois).

Coûts cachés des chèques pré-imprimés

Outre le coût du stock de chèques préimprimés, il existe un risque élevé de vol et de perte. Il est difficile de le quantifier, mais le temps et l'argent consacrés à la gestion du contrôle du stock de chèques préimprimés sont considérables, avant même de prendre en compte le coût des consommables. Il faut ensuite tenir compte du coût pour votre entreprise si quelqu'un vole quelques feuilles et encaisse des chèques sur vos comptes.

L'enveloppe

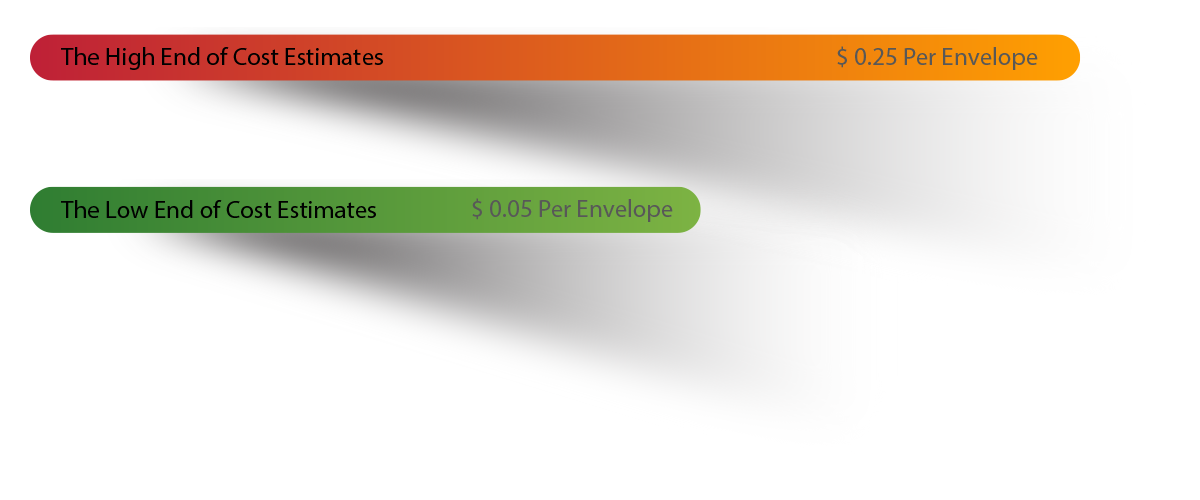

Il existe toute une série d'options à cet égard, l'emplacement de la fenêtre, les caractéristiques de sécurité et l'auto-scellage ayant une incidence sur le coût. Comme pour les chèques préimprimés, je pars du principe que les enveloppes sont au nombre de 250 :

Il peut être difficile d'estimer le prix des enveloppes. Contrairement aux chèques préimprimés, le risque est beaucoup plus faible et il est donc plus facile d'acheter en gros, ce qui permet de réduire le coût unitaire. Vous pouvez également opter pour plusieurs caractéristiques sophistiquées, allant de l'emplacement des fenêtres à la sécurité. Chaque choix aura un impact considérable sur le coût final.

L'imprimante

C'est là que les estimations de prix deviennent plus difficiles. L'achat de modèles d'imprimantes MICR moins chers peut permettre à votre entreprise d'économiser de l'argent au départ, mais vous courez le risque réel de pannes mécaniques. Une imprimante qui ne fonctionne pas, dans le meilleur des cas, ne peut pas imprimer vos paiements critiques, ce qui peut entraîner des retards et potentiellement des frais ou, pire encore, la nécessité de remplacer l'imprimante des années plus tôt que prévu. Sans parler des coûts cachés des plans de service et du manque d'assistance de la part du vendeur.

Le toner

Le toner MICR est ce qui importe vraiment pour l'impression des chèques. Non seulement les banques exigent l'utilisation d'un toner MICR, mais elles imposent également des spécifications de qualité, et tous les toners MICR ne sont pas identiques. S'approvisionner en toner MICR bon marché comporte le risque d'obtenir de faibles rendements ou d'être rejeté par les banques parce qu'il ne répond pas aux exigences. Ces deux scénarios coûteront du temps et de l'argent à votre entreprise. Ceci étant dit :

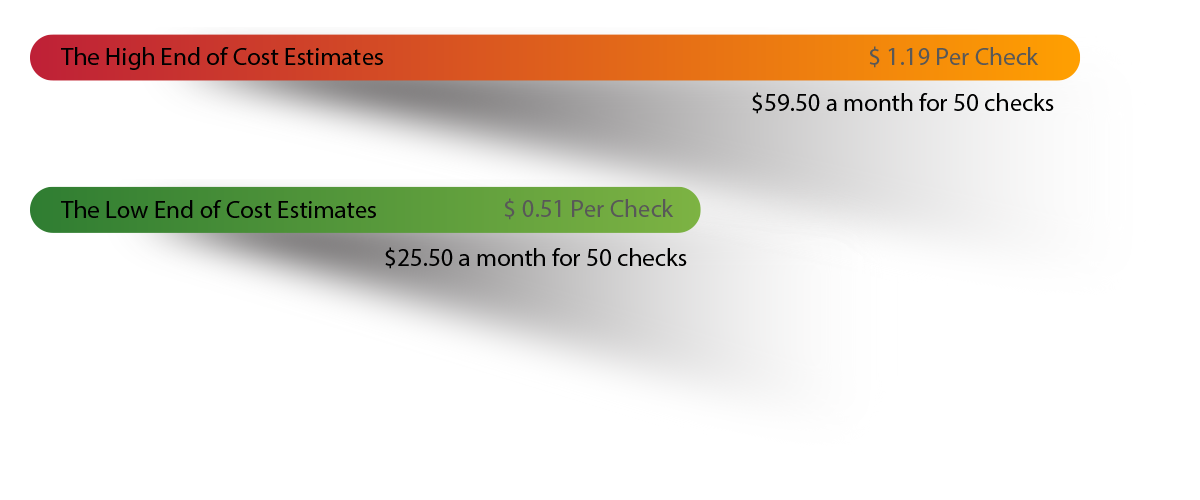

La mise en place de l'ensemble !

Je tiens à être très clair sur ces estimations. Il ne s'agit que d'un coût minimum absolu par contrôle et, plus précisément, d'un scénario d'utilisation parfait. Je ne peux imaginer aucun processus ou flux de travail qui fonctionne parfaitement, qui ne soit pas le reflet du monde réel. Il s'agit d'un point de départ. Voici une liste incomplète de choses qui peuvent se produire et qui se produisent effectivement et qui ont un impact sur les coûts d'impression d'un chèque :

Les enveloppes se déchirent et ne peuvent plus être utilisées.

Il arrive que les imprimantes bloquent l'impression, ruinant ainsi un stock de chèques coûteux.

L'erreur humaine peut être à l'origine de toutes sortes de réimpressions.

Les rendements en toner ne sont que des estimations.

Les imprimantes/machines tombent constamment en panne.

Viennent ensuite les coûts de main-d'œuvre, le temps perdu à remplacer les pièces, les retards/frais causés par la livraison tardive du stock de chèques ou du toner. La liste des coûts varie d'une entreprise à l'autre, mais elle double ou triple rapidement le coût de chaque chèque imprimé. Lorsque vous examinez les coûts réels de l'impression de chèques pour votre entreprise, vous pouvez facilement dépenser 150 à 200 dollars par mois pour l'impression de 50 chèques, rien qu'avec les consommables. Lorsque vous incluez le coût de la main d'œuvre et du temps de travail et que vous calculez le coût de l'envoi, vous vous rapprochez rapidement de la fourchette de 200 à 1 000 dollars pour 50 chèques.

Il est important de mettre en lumière les coûts réels de l'impression des chèques. Il est facile de penser que le coût est faible parce qu'il s'agit simplement d'un chèque, d'un morceau de papier. Même si ce papier est d'une importance capitale. Souvent, une entreprise peut considérer la nécessité d'envoyer des chèques comme un simple coût d'exploitation. En outre, les banques rendent les chèques compliqués, de sorte qu'il ne vaut pas la peine de chercher un meilleur moyen.

Tout cela est faux.

Il existe de meilleures façons d'imprimer des chèques qui respectent les normes bancaires tout en permettant à votre entreprise d'économiser de l'argent. Les experts du Groupe TROY aident chaque jour les petites et grandes entreprises à imprimer des chèques, à traiter les paiements et à sécuriser les documents. Dans la prochaine partie de cette série de blogs, j'explorerai les alternatives à l'impression de chèques que de nombreuses entreprises utilisent déjà avec plus ou moins de succès. Vous connaissez peut-être déjà l'ACH, mais connaissez-vous les chèques électroniques ou les chèques numériques ? Connaissez-vous les frais associés à ces types de paiement ? J'aborderai ces questions et d'autres encore la prochaine fois !

Articles connexes

Votre guide pour choisir le meilleur logiciel d'impression de chèques

Dans le monde rapide des affaires, l'efficacité est essentielle. L'un des domaines où l'efficacité peut avoir un impact significatif est celui de l'impression des chèques et des logiciels d'impression de chèques. En tant que..

5 avantages de l'impression avec des encres à séchage UV

Dans le secteur de l'impression, la rapidité et la fiabilité revêtent une importance capitale. Les clients veulent que leurs travaux d'impression soient réalisés rapidement et sans risque de dommages ou de bavures. L'entreprise..

5 Avantages d'une machine d'insertion de plis

Commençons ce blog par l'histoire simple de Mark, un responsable du service des comptes fournisseurs chargé des responsabilités financières d'une entreprise en pleine croissance. Au fur et à mesure que l'entreprise se développe, so..

Laisser une réponse